In the modern economy, companies are not only operating to make a profit or to increase their scale of operations. They play an influential role in society as well as the developmental framework of the nation. Corporations have access to wide markets, advanced technologies, and talented individuals, which help them not only to succeed but also to become financially stable. But alongside their achievements, they acquire a duty, the duty to pay back to the community that fosters their development. This is where the concept of Corporate Social Responsibility (CSR) gains light.

In India legal foundation of Corporate Social Responsibility (CSR) is Section 135 of the Companies Act, 2013. It requires companies that exceed a specified financial threshold to invest at least 2% of their average net profits for the previous three years in CSR initiatives. These activities can be from a wide range of sectors such as education, health care, women's empowerment, environmental protection, and rural development.

However, a genuine concern arises in fulfilling corporate social responsibility (CSR) commitments, which is identifying a suitable partner. Despite the large number of NGOs in India, only a few have the trustworthiness, funding, or mechanisms to achieve real impact. The repercussions of picking the wrong NGO extend beyond CSR objectives; they can lead to financial, legal, and reputational risks to the company. Here comes a critical step of due diligence by the company before engaging with any NGO as a partner. Due diligence is a structured assessment process to verify an NGO’s credibility, previous work, compliance, and ability to deliver. This enables firms to validate truths, the risks attached to that NGO and ensure that their objectives align with our own CSR vision. Bypassing this step can result in funds being misused, a public backlash, and legal troubles.

To conduct the fair due diligence process, a CSR committee is formed according to section 135(1) of the Companies Act 2013, which comprises 3 or more members of the board of directors (in which one has to be an independent director). The main role of these committees is to address the five main sets of questions for meeting their Corporate Social Responsibility:-

Is the NGO legally registered?

Does the NGO have a transparent governance structure?

Are the NGO's financial systems reliable, and can they manage CSR funds responsibly?

Is the NGO effective in implementing projects at the grassroots level?

Is the proposed project viable, and does the NGO have the capacity to execute it successfully?

How will the company attract CSR?

As per Section 135(1) of the Companies Act, 2013, Corporate Social Responsibility (CSR) has to be fulfilled by every company, including holding, subsidiary, or foreign company having a branch or project office in India, if it satisfies any one of the following conditions during the immediately preceding financial year:

Net worth of ₹500 crore or more,

Turnover of ₹1,000 crore or more, or

Net profit of ₹5 crore or more.

For Corporate Social Responsibility (CSR) purposes, net profit is calculated in accordance with Section 198 of the Act, which governs how profits are computed for managerial remuneration and CSR. It involves adjustments to the Profit Before Tax (PBT) as per the financial statements prepared under Schedule III of the Act. While computing net profit under Section 198, the following must be excluded:

Profits earned from any overseas branch of the company, whether operating as a separate entity or not.

Dividends received from other Indian companies that are also complying with CSR provisions under Section 135.

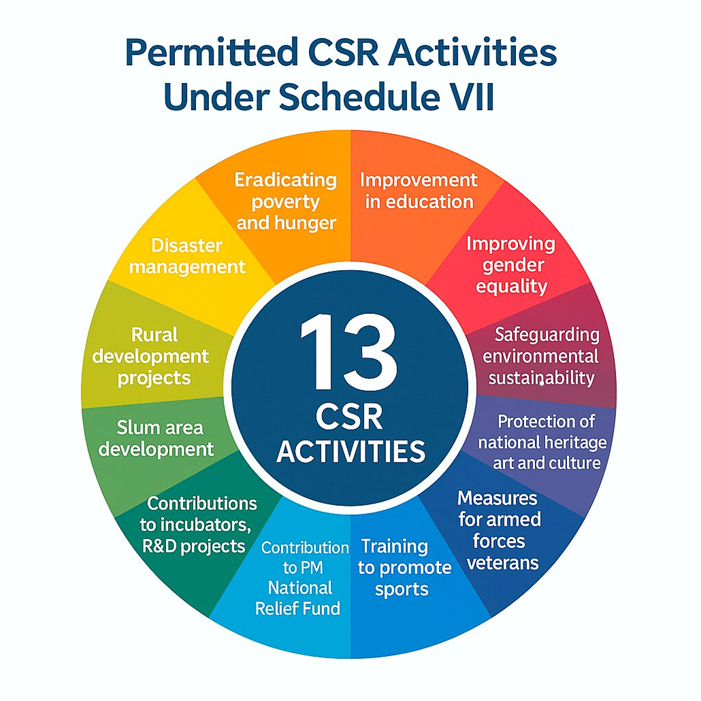

Legal Framework and Key Amendments to CSR Rules To legally recognized Corporate Social Responsibility (CSR) activities and how they should be governed, The Companies (Corporate Social Responsibility Policy) Rules, 2014 were introduced under Section 135 of the Companies Act, 2013. These rules define the scope of Corporate Social Responsibility (CSR), outline the constitution and duties of the CSR Committee, and prescribe the

eligible activities listed under Schedule VII of the Companies Act 2013.

Over time, various key amendments have strengthened the compliance and accountability framework under Corporate Social Responsibility (CSR) regulations. The Ministry of Corporate Affairs has issued Companies (Corporate Social Responsibility Policy) Amendment Rules 2021 dated 22.01.2021, which mandate registration of all implementing agencies on the MCA portal through Form CSR-1, ensuring that only verified and eligible entities are entrusted with CSR funds. This step was aimed at improving transparency and helping companies identify credible partners.

Additionally, the notification inserted sub-rule (3) under Rule 8 of Companies (Corporate Social Responsibility Policy) Rules 2014, which mandated impact assessments for Corporate Social Responsibility (CSR) projects that have been completed, not less than one year prior and exceeding ₹1 crore and more, and for every company having an average CSR obligation of ₹10 crore or more over the past three financial years in pursuance of section 135(5) of the Companies Act, 2013.

Also, to make an impactful assessment, the 2021 notification updated Rule 7 in the Companies (CSR Policy) Rules 2014, with an expenditure cap limited to 5% on total CSR expenditure or fifty lakh, whichever is lower, for that financial year, was imposed on the company.

A major amendment came through the substitution of Rule 4(1) in the Companies (CSR Policy) Rules 2014, which sets out the criteria for entities through which a company can undertake CSR activities. These 2021 amendments ensure that Corporate Social Responsibility (CSR) may be carried out either singly or in collaboration with another company:-

The board should make sure that Corporate Social Responsibility (CSR) activities are performed by the company itself or through:-

A company established under Section 8 of the Act, or a registered public trust or a registered society, or registered under Section 12A and approved under Section 80G of the Income Tax Act, 1961 or has exemption under sub-clauses (iv), (v), (vi), or (via) of clause (23C) of Section 10 of the Income Tax Act, 1961, established by company, either singly or along with another company.

A company established under Section 8 of the Act, or a registered public trust or a registered society, registered under Section 12A and approved under Section 80G of the Income Tax Act, 1961 or exemption under sub-clauses (iv), (v), (vi), or (via) of clause (23C) of Section 10 of the Income Tax Act, 1961 having a track record in undertaking similar activities from at least three years.

A company established under Section 8 of the Act, or a registered trust or a registered society, established by the Central Government or State Government.

Any entity established under an Act of Parliament or a State Legislature.

Subsequently, on 20 September 2022, the Ministry of Corporate Affairs issued another notification introducing further amendments aimed at streamlining the implementation of Corporate Social Responsibility (CSR). One such change clarified that even if a company holds funds in its Unspent Corporate Social Responsibility Account, it is still required to constitute a CSR Committee, in accordance with Section 135(6) of the Act.

Further, Rule 8(3) of the Companies (Corporate Social Responsibility Policy) Rules, 2014, was also amended in the 2022 notification to revise the administrative overhead cap for impact assessments. The limit was reduced from 5% to 2% of total CSR expenditure, and the basis for calculation was reversed from "whichever is lower" to "whichever is higher".

DUE DILIGENCE FOR CSR ACTIVITIES

Due diligence is necessary for a detailed and proper examination of NGOs before starting a collaboration or formally involving oneself with them. It is the key step as it decides whether the company should trust its finances to that particular NGO for CSR activities or not. Due diligence is not conducted for every NGO that is showing interest; it is only done if:

There has been some initial contact with the NGO

NGO has given a proposal, and the proposal is seen to be worthy of support within the CSR mandate of the company.

It is ascertained that those funds are available to support the proposal.

Conducting due diligence of NGOs tends to be a time and funds-consuming process; it is also a subject matter of expertise. To simplify the procedure of this decision-making process, Section 135 of the Companies Act, 2013, provides for the constitution of a CSR Committee. This committee is responsible for drafting the CSR policy, selecting suitable projects for CSR, recommending the CSR activities for expenditure, and monitoring their implementation. One of its key responsibilities is to evaluate how Corporate Social Responsibility (CSR) obligations should be fulfilled, whether directly by the company's in-house organization or through implementing agencies such as NGOs. NGOs usually propose detailed projects describing objectives, areas of work, timelines, budgets, and outputs. These proposals are then scrutinized by the CSR Committee in relation to companies' Corporate Social Responsibility (CSR) goals. For effective decision-making, it is expected that the head or members of the committee should possess working knowledge of community organization, legal frameworks, financial management, and NGO operations. The final decision of whether the NGO is suitable or unsuitable for partnership is of the CSR committee only. The main objective of this committee is not to select the unsuitable NGO. Ultimately, the CSR Committee ensures that the selected partners can deliver measurable impact while adhering to all regulatory and ethical standards.

RIGOROUSNESS IN DUE DILIGENCE

The depth and intensity of due diligence conducted on an NGO are not uniform; they vary depending on various factors considered in the CSR proposal.

Nature of the Proposal:

TheProposal can be of any type or kind, it can be long-term or short-term, or from a grassroots working organization or a service delivery organization. The level ofevaluation of due diligence depends on these factors of the proposal.Size of the Project (Financial Outlay):

The larger the funds involved in the project, the stricter the scrutiny is required for that project. The committee has to ensure whether the NGO can perform the required CSR goals.Criticality of the Project:

All CSR projects are different from one another, so accordingly, the more critical projects require more due diligence compared to projects it is small and simple. The wrong choice of an NGO can cause complications for the company in future.

Due Diligence Procedures for Assessing ngos

The due diligence process begins with a desk review of the NGO's documentation. This includes examining registration certificates, PAN, Memorandum of Association (MOA), Articles of Association (AOA), 12A/80G approvals, Form CSR-1, financial statements, and previous project reports. The aim is to verify the legal validity of the organisation and to assess whether the NGO aligns with the company's CSR requirements. Also, they should be legally registered for at least three years (unless it is a company-controlled NGO) before they receive a CSR grant.

If the NGO has foreign investors, then it must hold a valid FCRA registration and file FC-3 returns with the Ministry of Home Affairs. However, not having FCRA approval does not automatically disqualify an NGO from being selected for CSR funding.

After the initial review, the CSR Committee or its representatives may conduct an on-site visit to the NGO's office and project areas. This helps validate information, check infrastructure, and interact with beneficiaries to understand the actual impact of the NGO's work.

They can adopt these practical tests:

The Petty Cash Test: Check the NGO's daybook and verify if the recorded petty cash matches the actual cash available in the office.

The Small Donation Test: Make a nominal personal donation to assess how the funds are recorded, the type of receipt issued, and whether proper separation of duties is maintained in handling cash.

Follow a Voucher Test: Select a few financial vouchers at random and trace each transaction through the NGO's financial system to ensure accountability and accurate bookkeeping.

To make the process smoother, companies often hire consulting, audit, or advisory firms. These professionals conduct independent evaluations of the NGO's financial systems, governance structure, and field operations using standard assessment tools.

Should consider these public platforms, such as Credibility Alliance, GuideStar India, and the NGO Darpan portal, for cross-verification. These sources might offer insight into the NGO's reputation, past performance, and compliance history.

Considerations for CSR Engagement in NGO Selection

There are an ample number of NGOs that function differently from each other, such as some working at the grassroots level, some advocating for policy formation, running awareness campaigns, delivering direct services, and many more. These functional differences change the role of the NGO in the market, and therefore, the committee should know what type of NGO they need to engage with to fulfil their CSR objectives.

The CSR Committee considers the governance and control structure within the NGO. The committee reviews how it is managed—whether it is led by a board with a CEO accountable to the board, or a family-run entity, such as those operated by spouses or individuals with unilateral authority. It is important to know who calls the shots within the organisation and how they function, as this reflects transparency and institutional integrity within the organisation.

Another factor that affects the decision is the background of the founders, board members, and key functionaries. It is thoroughly verified to identify whether there is any criminal history, ongoing litigation, or regulatory breaches committed by any member or organisation. A clean record and well-managed structure of the organisation help to gain the trust of corporate partners.

The purpose of the company in investing through an NGO is to claim the tax benefits provided by law. So, they look out for NGOs that are eligible for tax benefits under Sections 80G or 35AC of the Income Tax Act. This allows both the organisation and the investor to claim tax exemptions and enhance credibility in financial practices.

Another key factor is the NGO's financial capacity and management capabilities. It is important to take into consideration the organisation's internal controls, fund utilisation and management, past audit reports, annual statements, and many more to judge whether the NGO can manage CSR funds responsibly and transparently.

The track record of the NGO is also a crucial indicator. The committee should look into the scale and impact of past programs, consistency in project delivery, and feedback from beneficiaries or third-party evaluations to evaluate the actual performance of that NGO on the ground.

Organisational networks and their affiliations with other organisations or government departments and schemes are also important factors to consider, as they reflect the NGO's goodwill in the market. Their engagement in government schemes like Beti Bachao Beti Padhao (BBBP), POSHAN Abhiyaan (National Nutrition Mission) and many more, which shows their presence in the market and their ability to perform suitable CSR activities.

Donor credibility is an additional factor, as it is important to know who funds the organisation, which other foundations, international institutions, companies, etc., are linked with the particular NGO. It serves as the backbone of the organisation, reflecting how efficient that organisation is and how well it utilizes and manages significant donors.

It is important to note that NGOs should not perform CSR activities with any biases for any company, such as performing tasks solely for the benefit of a company's employees or as part of their ordinary course of business.

EXAMPLE OF COMPANY - NGO PARTNERSHIP

IKEA Foundation and Save the Children

. The IKEA Foundation has a partnership with Save the Children, mainly focusing on child rights, their education, and providing disaster relief across multiple countries. The foundation's CSR model involves large-scale goals, with maintaining a good governance structure.Mahindra & Mahindra and Naandi Foundation

The Naandi Foundation, in collaboration with Mahindra & Mahindra, has taken initiatives pertaining to corporate social responsibility(CSR), including the education and development of the girl child on a massive scale with the "Nanhi Kali" project. This partnership is seamlessly woven into the CSR landscape of the Mahindra Group and is featured on a continual basis in the CSR reports of the Group.PepsiCo India and WaterAid India

PepsiCo India collaborates with WaterAid India to implement water, sanitation, and hygiene (WASH) in rural areas facing severe water scarcity. This collaboration falls under the CSR commitment of water stewardship for PepsiCo at a global level and requires thorough monitoring and assessment.

CONCLUSION

In today's business landscape, it has become crucial for organizations to emphasize social welfare along with their operational profits. The emergence of Corporate Social Responsibility (CSR) reflects a company's conscious effort to merge business economic goals with social welfare. However, it is important to note that CSR is not simply about providing charity; it is about effective distribution and ethical management. Hence, due diligence becomes a significant component of Corporate Social Responsibility (CSR).

The decision regarding the right NGO partner is not something that can be taken for granted. A trustworthy and skilled implementing agency determines the fragile line that separates effective community change from community change that has failed. Due-diligence helps a company to evaluate an NGO's legal compliance, finances, governance, operational capabilities, and programmatic productivity. This assessment processsignifies the organisation's ethics, history, governance, CSR compliance, and values.

The recent changes to CSR regulations have made adherence to the processes that stress the need for aligned partnership due diligence compliance in factors such as social collaborations and socially responsible practices. A single wrong choice could exhaust resources and pose a huge legal and societal taint to the firm. It enables the firm to protect and sustain alliances that are efficient, achievable and dependable in all the socio-economic and environmental objectives of a company and guarantees them to be socially responsible and more productive.

This newsletter has been contributed by:

Navin Kumar, Advocate, Supreme Court of India

and assisted by Arnav Jain

For further information contact:

Law Offices of Navin Kumar

Email: info@navinlaw.in

Disclaimer: This newsletter is for information purposes only. Nothing contained herein is purported to be or is intended as legal advice and the reader should seek formal legal advice before acting on any information or views expressed herein. Receipt of this newsletter shall not be construed as an attempt to advertise or solicit business in any manner whatsoever. For private circulation to the addresses only.

Write a comment ...